Into the War Zone

A first-hand account by Dana Costin, Founder of ROLDA At ROLDA, we like to say that our volunteers are the heart of the charity. The passion, dedication and determination of our volunteers make such a difference that they help shape our future. Small charities can be highly dependent on volunteers, especially when they cannot afford ... Blog

Left Behind: The hidden underbelly crisis of strays in Ukraine and Romania

On a quiet road in Ukraine, a dog lay trembling in the dirt. Her leg was bent at an unnatural angle. She had likely been hit by a car. No collar, no identification, and no one nearby to help. Her name is Hanna, and her story is heartbreakingly common across Eastern Europe right now. When ... Left Behind: The hidden underbelly crisis of strays in Ukraine and Romania

Odin’s Journey of Survival After a Vicious Dog attack

Stray cats have the unique ability to make almost anywhere their home. They fight fiercely for their independence and maintain that typical standoffish cat behavior; but the harsh reality is that many would not survive without help. Every day, these resilient animals face overwhelming challenges – finding food to fill their rumbling stomachs, warding off ... Odin’s Journey of Survival After a Vicious Dog attack

What does being a no-kill shelter mean, in practice, to a cat?

We are occasionally asked what a no-kill shelter is. This story is a very recent example of a no-kill policy in action, to help explain how it works and why it is crucial. One of our sister rescue shelters, the Great Catsby, has been caring for a beautiful little white female cat called Cris since ... What does being a no-kill shelter mean, in practice, to a cat?

Marik’s story demonstrates how Ukrainian soldiers fight to defend those they love

Marik is a blind, stray dog in Ukraine. As such, his chances of surviving long were tiny. Life can be tough for anyone who is blind. Let alone a stray dog. Marik would not have lasted long, given the increased competition for scarce food and water as a stray and the added risk of being ... Marik’s story demonstrates how Ukrainian soldiers fight to defend those they love

Winnie, the tiny stray cat who surprised us all

Sterilization programs are one of the surest, most efficient ways of managing strays in the long term. As the number of homeless animals continues to rise, the challenge of protecting them becomes even more urgent. But, finding time to sterilize is still a priority. Winnie was a stray, taken to be sterilized at ROLDA partner ... Winnie, the tiny stray cat who surprised us all

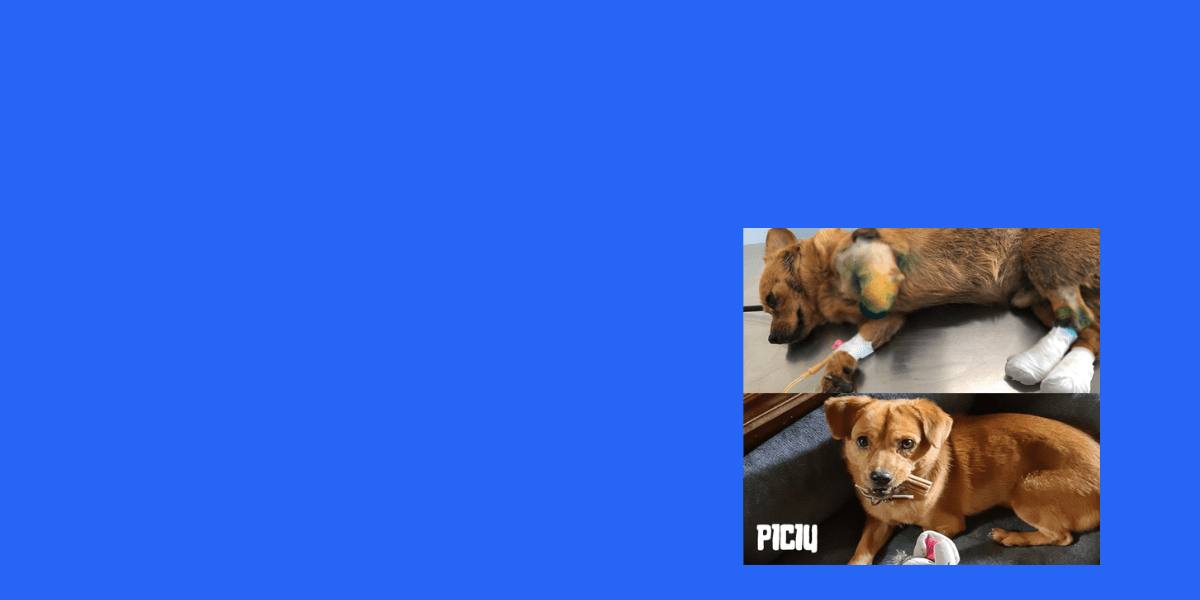

Ada’s road to recovery: giving her a second chance to walk

She may never walk properly again. But if that’s the case, we will know we tried everything possible to help her first. Only a few seconds of bad luck means Ada faces the harsh possibility of never being able to walk again. More frequently than ever, we help dogs hit by cars. Some sustain only ... Ada’s road to recovery: giving her a second chance to walk

Healing a broken spirit: Knopa’s path to recovery and safety

Sadly, it is not uncommon for animals to face human cruelty and brutality. It is unimaginable how heartless people can be. ROLDA has helped so many animals with horrible pasts. We have helped cats thrown from windows and dogs chained outside in the cold, hungry for days on end. We have helped abused animals kicked ... Healing a broken spirit: Knopa’s path to recovery and safety

Finding light in darkness: Lew’s path to a new life

Romania is home to over a million stray animals. While many locals do their best to care for the strays in their neighbourhoods—especially the smallest and most vulnerable—not every animal is lucky enough to find kindness. Lew, a tiny kitten just three or four months old, was one of the fortunate ones. Despite her playful ... Finding light in darkness: Lew’s path to a new life

Hope Amidst the Chaos: A Ukrainian Dog’s Journey to Healing

In a country where the sound of missiles, gunshots and sirens has become as common as birdsong, where streets bear the scars of conflict, and where survival often hinges on split-second decisions, there are still those who refuse to let compassion become a casualty of war. This is the story of Nadya, a dog whose ... Hope Amidst the Chaos: A Ukrainian Dog’s Journey to Healing

A Duchess Among the Ruins: One Cat’s Journey from Street Survivor to Beloved Fighter

In the early days of Russia’s invasion of Ukraine, while most were fleeing the sounds of distant artillery and air raid sirens, Madalina made a choice that would change not only her life but the lives of countless forgotten felines in her war-torn city. Among these souls was a street cat who would come to ... A Duchess Among the Ruins: One Cat’s Journey from Street Survivor to Beloved Fighter

From Despair to Hope: Sarah’s Incredible Journey of Survival

Sarah’s journey is heartbreaking and yet inspiring. First, the heartbreak…Imagine being tossed out of the window of a moving vehicle. The instant spike of fear you would feel as it happened, the overwhelming building pain in the seconds after you hit the ground. The open wounds that would cover your body. That is what poor ... From Despair to Hope: Sarah’s Incredible Journey of Survival

Bibi’s Battle Against Liver and Kidney Failure

An inflamed and bleeding mouth. Kidney failure. Liver failure. Bibi, the little stray kitten, was suffering from all. When our friends at the Great Catsby in Romania found Bibi, they immediately knew they needed to help her. The Great Catsby is one of the shelters ROLDA is fortunate enough to support doing great work. Due ... Bibi’s Battle Against Liver and Kidney Failure

How do you train an older dog not to bite?

As much as we love our dogs and as much as we understand their instincts, biting remains objectively wrong. This is primarily because of its obvious harmful effects and the legal implications for the owners of dogs that bite. Sometimes, it might depend on the context in which the bite occurred and the severity or ... How do you train an older dog not to bite?

How do I get my puppy to stop crying?

Getting a puppy can be the most exciting moment of anyone’s life. Even as children, we dream of the unbreakable bond we will have with our dog, a bond created since puppyhood. The training part, however, hits like a ton of bricks! As aware as you might think you are of all the things you ... How do I get my puppy to stop crying?

Understanding Canine Behavior: What Your Dog’s Actions Reveal

Here is something that sounds difficult to do before you have a dog: understanding them and being able to have a “conversation.” You might think that only professional trainers and seasoned dog owners will know the significance behind every sniff and growl. Still, the experience will soon teach you that any dog owner with a ... Understanding Canine Behavior: What Your Dog’s Actions Reveal

Dana’s Journey to Ukraine, October 2024

Compassionate Impact Report: capturing the sights, sounds, and stories of resilience. With a heart full of dedication and compassion, Dana Costin, CEO of ROLDA, embarked on a five-day mission to Ukraine in October 2024 travelling to the Kharkiv region, where she provided crucial support for animal rescue operations near the front lines. With a van ... Dana’s Journey to Ukraine, October 2024

Stranded: Bridge’s encounter with the ROLDA Rescue Team

BOOM. A terrified dog huddles in the shadows, watching and hearing Russian missiles explode around him. BOOM. Our terrified dog hears people shouting and screaming as flames fill his surroundings and dark shadows flee for safety all around. BOOM. Our terrified dog turns to run as the foundation of his home, just meters away, is ... Stranded: Bridge’s encounter with the ROLDA Rescue Team

The blind kitten who chooses love

Thousands of stray cats live on the streets of Romania. No love or joy for them. Survival is all they can afford to think about. Street dogs chase them for the tiniest scrap of food found in the gutter. Toxic, bacteria-filled environments and harsh weather conditions cause disease and sickness to threaten their fragile bodies. ... The blind kitten who chooses love

Why Families with Children Should adopt a Shelter Dog

Families, especially those with children, can find immense satisfaction and happiness by deciding to adopt a dog from a shelter. By bringing home a shelter dog, families not only provide a loving home but also give children a special chance to learn compassion, responsibility, and more. Families with children can experience many benefits by adopting ... Why Families with Children Should adopt a Shelter Dog

Toxic Plants that Can Harm Your Dog

When we imagine happy dogs at play, we often picture them outdoors feeling the softness of the grass beneath their paws, their noses twitching as they take in the scent of every flower. It’s a heartwarming sight, observing them in their blissful state—until their attention turns to devouring a plant or exhibiting an excessive fascination ... Toxic Plants that Can Harm Your Dog

Dealing with Common Canine Health Issues: Prevention and Treatment

While owning a dog brings immense joy and love, it’s crucial to recognise the responsibility that comes with ensuring their health and well-being. As much as we hate to imagine it, our furry companions are susceptible to health problems and accidents as they age, just like humans. Taking the steps of providing proper care, practicing ... Dealing with Common Canine Health Issues: Prevention and Treatment

Ensuring a Safe Home: Practical Dog-Proofing Tips for New Pet Owners

The anticipation of bringing home a new dog creates a palpable sense of excitement. You’re likely picturing all the delightful moments in store, such as your pup relaxing on the comfortable couch or joyfully exploring the vibrant yard. It is essential to make your home safe and comfortable for your new pet. Prior to the ... Ensuring a Safe Home: Practical Dog-Proofing Tips for New Pet Owners

How to Keep Your Dog Mentally Stimulated with Toys

Dogs, much like humans, can feel bored with the repetitive daily routine. While routines are important for keeping things organised, it’s worth considering how this influences your dog’s sense of stability and predictability. A predictable environment is beneficial for dogs, but an excess of monotony can induce boredom and a sense of restlessness. Dogs, being ... How to Keep Your Dog Mentally Stimulated with Toys

The Devastating Floods in Galați County, Romania

As the floods struck Galați County in the dead of night, terrified residents scrambled to find safety, seeking refuge in attics or scrambling to higher ground in a desperate bid for survival. Tragically, the floods claimed seven lives and reduced countless homes to rubble, leaving the affected with nothing in a mere moment. International news ... The Devastating Floods in Galați County, Romania

non-US support +44 (0)161 531 8801

non-US support +44 (0)161 531 8801